Harnessing Whole Life Insurance: Your Path to Becoming Your Own Bank

Explore the ways in which insurance can be a valuable asset allowing you to manage your wealth and function as your own financial institution. This comprehensive guide will shed light on the advantages of life insurance revealing how you can leverage its cash value to achieve independence.

Understanding Life Insurance Beyond Death Benefits

Life insurance is commonly seen as a way to protect loved ones after someone is gone. However it offers more than just death benefits. With a whole life insurance policy's cash value feature policyholders can tap into their investment through loans, allowing them to access funds while maintaining coverage.

By recognizing the twofold role of life insurance people can utilize it as a valuable tool. This gives them the flexibility to make big purchases or investments without depending solely on banks.

Life Insurance as a Wealth-Building Tool

While some see insurance as a cost it can actually be a valuable asset for wealth accumulation. Unlike conventional retirement savings that come with age restrictions on withdrawals life insurance policies offer the option to borrow against their cash value.

This adaptability allows people to seize opportunities that can boost their income and improve their financial assets. For example one might utilize borrowed money to venture into real estate or other businesses essentially using their life insurance policy as a private bank.

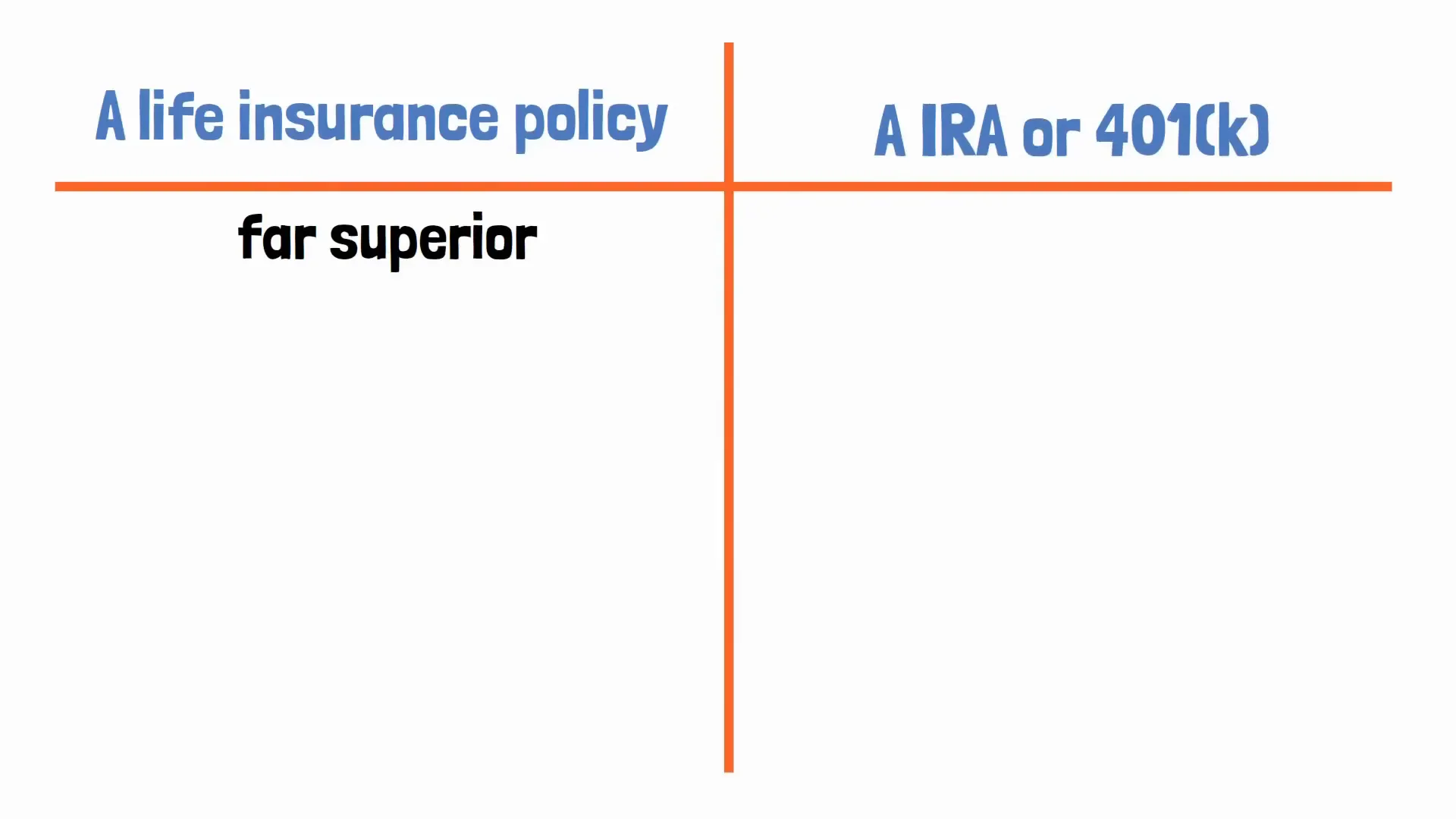

Comparing Life Insurance to Traditional Investments

When looking at insurance and other investment options such, as IRAs or 401(k)s it's clear that life insurance has its benefits. Regular accounts usually have fees for taking out money early and don't promise returns which can be frustrating financially.

On the hand whole life insurance policies offer returns and permit tax free growth on earnings fostering a investment atmosphere. This difference underscores the growing trend among investors to consider life insurance as a key element in their financial plans.

The Big Five Benefits of Whole Life Insurance

Whole life insurance policies offer a set of advantages, known as the 'Big Five' that make them attractive as financial assets. These benefits include.

- Guaranteed Returns: These policies offer contractually guaranteed returns, providing a stable income source.

- Dividend Accumulation: Policies can accumulate dividends over time, adding to the cash value.

- Tax-Free Growth: Earnings grow without being taxed, maximizing investment potential.

- Policy Loans: Borrowing against the policy allows access to cash while retaining insurance coverage.

- Death Benefit: The policy provides a financial safety net for beneficiaries.

Guaranteed Returns Explained

One key benefit of whole life insurance is the assurance of returns. Unlike investments whole life policies offer a consistent return typically about three percent guaranteeing a steady flow of income. This reliability is especially attractive, to individuals looking to reduce risk in their investment strategies.

In addition several insurance providers throw in benefits like cash rewards or no interest loans, enhancing the policies worth beyond its purpose.

Dividend Accumulation and Its Benefits

Another important aspect of life insurance is its capacity to earn dividends. Throughout the policies duration it has the potential to yield dividends, ranging from two to three percent. These dividends offer flexibility, allowing policyholders to either lower their premiums or increase their coverage.

This feature gives policyholders the power to customize their policies according on their financial objectives. In the end this adaptability plays a role in using insurance as a means of wealth accumulation.

The Advantage of Tax-Free Growth

One of the persuasive reasons to look into life insurance is the tax advantage it provides. In contrast to investment options the returns from a whole life policy aren't taxed as income. This implies that all growth builds up without the weight of taxes enabling your wealth to grow more efficiently over time.

Over the term this aspect has the potential to greatly improve your financial plan. Utilizing the benefits of life insurance allows you to keep a portion of your income that can be reinvested to grow your wealth even more.

Utilizing Policy Loans for Financial Flexibility

One notable benefit, of life insurance is the option to take out loans against your policy. This feature enables you to tap into the value of your policy giving you flexibility during times of financial need. Rather than depending on banks and going through approval processes you can easily access your funds.

When you take a loan against your insurance policy, you're essentially borrowing from your own savings. This allows you to use the money for things like investing in property, paying for education or handling unexpected costs. The loan interest rates are usually more favorable than what banks offer, which makes it an appealing choice for many policyholders.

The Role of Death Benefits in Life Insurance

When people think about life insurance the death benefit often takes center stage. However it's important to understand that this is only a part of a whole life policy. The death benefit acts as a cushion for your family providing them with assistance in the unfortunate event of your passing.

Nonetheless the primary motivation for acquiring life insurance shouldn't solely be the death benefit. Rather it ought to be seen as an extra safety net that enhances the wealth accumulation approaches offered by the policies cash value and loan features. This perspective transforms life insurance into a versatile financial instrument, offering both safeguarding and opportunities for growth.

Strategies for Wealth Creation with Life Insurance

To fully leverage the benefits of life insurance as a means of accumulating wealth it's important to take approaches. One smart tactic involves taking out a loan against your policy to invest in assets. For instance using borrowed money to buy properties can generate income, which boosts your overall financial standing.

Additionally by consistently reinvesting the profits from these investments you can establish a compounding effect that greatly enhances your overall wealth. This approach effectively transforms your life insurance policy into a valuable asset enabling you to accumulate wealth while retaining insurance protection.

The Importance of Flexibility in Financial Planning

Flexibility plays a role, in a financial strategy. Whole life insurance provides this flexibility by giving policyholders the option to tap into their cash value as needed. This feature can prove essential during periods of uncertainty or when unexpected opportunities arise that require quick financial support.

With the option to borrow against your policy you have the freedom to make choices that align, with your goals without being restricted by traditional banking practices. This flexibility empowers you to take charge of your financial future and make well informed decisions that can contribute to building wealth.

Conclusion: Embrace the Bank of You

To sum up whole life insurance is not a safety net; its a flexible financial instrument that empowers you to manage your wealth. By grasping the benefits of growth using policy loans wisely and appreciating the significance of both death benefits and smart investments you can effectively leverage the potential of life insurance.

As you go through your journey keep in mind that you have the chance to be your own bank. By embracing the concept of being your own financial institution you can tap into the power of your resources and create a thriving future. Seize control of your path, today.

Comments

Post a Comment